MA BROWNFIELDS TAX CREDITS

The Massachusetts Brownfields Tax Credit program was created in 1998 and then amended in 2006 and 2010. We at EDI are responsible for drafting the most recent legislation and working for its adoption. We are experts at working with all aspects of this program and utilize this expertise on behalf of our clients.

This state tax credit provides financial incentive to developers, commercial property owners, business owners or tenants to clean (space) up contaminated sites. When a developer meets the qualifying criteria, up to 50% of their net qualified clean up costs can be refunded through state tax credits. Credits may, under certain circumstances, be earned retroactively even if the property has already been sold.

Both for-profit and not-for-profit developers are eligible to receive these credit(s) and to sell them to third parties (investors). Purchase of the credits affords its investors an opportunity to save on state taxes while supporting environmental integrity and contributing to the beautification and economic development of a community.

The Commonwealth of Massachusetts first created the Brownfields Tax Credit in 1998 and amended the legislation in 2006 to allow the credits to be transferred, sold or assigned. The tax credit program is administered by the Massachusetts Department of Revenue and offers eligible businesses and nonprofits a tax credit for the costs incurred to remediate contaminated property owned or leased for business purposes and located in an EDA. Tax credits may be used against state tax liabilities, or transferred or sold to third parties.

This credit provides an incentive to developers to clean space up qualifying sites in the form of tax credits useable against Massachusetts income tax. Purchase of the credits affords its investors an opportunity to save on state taxes, while supporting environmental clean ups in the state. These investments are short term, very safe and high yielding.

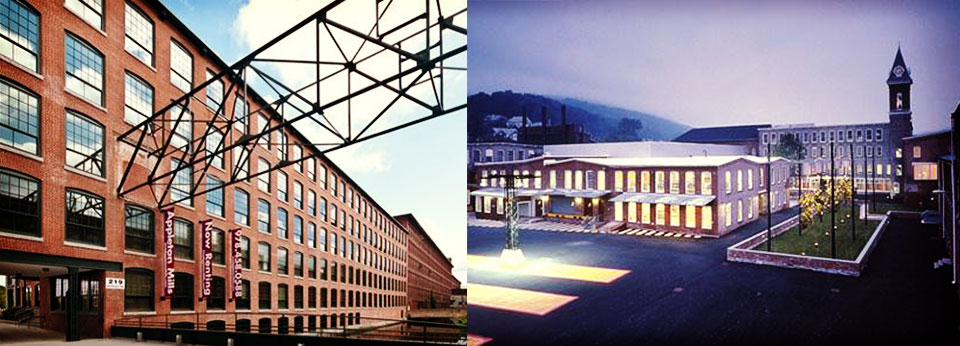

Brownfields are sites that have been contaminated by former industrial or commercial use. They are often in or adjacent to urban areas, and their redevelopment offers extraordinary opportunity to developers and communities alike. Brownfields redevelopment can be more complicated than building on greenfields, since it requires cleanup efforts, but it typically offers two benefits unmatched by greenfields: location and heritage.

Brownfields can provide developers with large plots in prime locations, enabling them to take advantage of greater proximity to the twin engines of urban economies, namely density and diversity. Communities also profit from brownfields redevelopment, as it activates dead space and reinvigorates entire neighborhoods. Because of its numerous benefits, brownfields redevelopment is eligible for many state and federal tax credits.

Who is Eligible?

Eligible properties must meet the following three conditions:

(1) the property is owned or leased by the taxpayer for business purposes

(2) the property has been reported to the Massachusetts Department of Environmental Protection (“MassDEP”)

(3) the property is located in an economically distress area (Economic Target Area qualifies)

Amount of the Brownfields Tax Credits

If an Activity and Use Limitation (“AUL”) is used, the credit amount is 25% of the net response and removal qualified costs. If an AUL is not used, the credit amount is 50% of the net response and removal costs.

Criteria for Application

1. The site was cleaned up under the guidance of a Massachusetts Licensed Site Professional (LSP).

2. The party conducting the investigation/remediation did not cause or contribute to the contamination, i.e. they were not responsible for the environmental issue to begin with.

3. The environmental clean up costs must exceed 15% of the assessed value of the property prior to the response action on or before remediation.

4. To qualify, the taxpayer must “commence and diligently pursue” the relevant environmental response action(s) on or before August 5, 2018. Also, the net response and removal costs must be incurred prior to January 1, 2019.

5. The amount of any federal or state funds or grants is deducted from the expense base for which the credit is available.